Overview

The Earned Income Tax Credit (EITC) has been supporting the incomes of low-income working families since 1975. It is now a major anti-poverty program for both adults and children. This brief provides an overview of how the Earned Income Tax Credit supports families in a context of wage stagnation and encourages work. Together with the Child Tax Credit, the EITC lifted 9.2 million people, including 4.8 million children, out of poverty in 2015. It has long-lasting benefits on maternal and children’s health and on children’s development. The EITC has therefore positive effects beyond its direct cash value to recipients.

Introduction

Since the mid-1970s, real wages among less educated workers have stagnated.1 More recently, in the past two decades, labor force participation has dropped for both men and women.2 Addressing these two salient features of the US labor market is a pressing issue.

A number of policies aim at supporting the income of the most disadvantaged. Among them, the minimum wage and policies that raise education and skills can directly lift earnings – before any taxes and transfers are made. Tax credits, such as the Earned Income Tax Credit (EITC), lift after-tax incomes for working families.

This policy brief focuses on the EITC, the central post-tax policy that aims at raising incomes and encouraging work among low-wage earners. Drawing on the most rigorous and recent research, including my own, I show that the EITC increases work and lifts millions of Americans out of poverty. The EITC has also a number of benefits beyond its cash value: it improves families’ health and children’s development.

The EITC increases work and lifts millions of Americans out of poverty

The EITC provides a refundable tax credit to lower-income working families through the federal income tax system. It provides clear incentives for individuals to enter the labor force as it increases the gap between the incomes of people who work and those who do not.3 Many studies have found that the EITC substantially increases work, in particular among single parents.4 In a recent paper, Ankur J. Patel and I find that the 1993 expansion of the EITC increased employment for single mothers with less than a college degree by 6.1 percentage points.5 Among single parents, the EITC leads to a large net increase in employment and thus earnings for low to moderate income families – with incomes between 75% and 250% of the federal poverty line. Because the EITC is based on family income, the credit is also expected to reduce the labor supply of secondary earners, as families adjust work in response to income increases. The evidence shows that the EITC leads to small reductions in the employment of married women, consistent with the predictions.6

The EITC is the cornerstone of U.S. anti-poverty policy. It is the largest anti-poverty program for children in the U.S.7 Together with the Child Tax Credit (CTC), the EITC removed 4.8 million children from poverty in 20158. It is also the second largest anti-poverty program for the population as a whole. Together with the CTC, the EITC lifted a total of 9.2 million people out of poverty in 2015. Only Social Security removes more people from poverty.9

The large anti-poverty effects of the EITC reflect the fact that the program reaches a large share of U.S. families with relatively generous amounts:

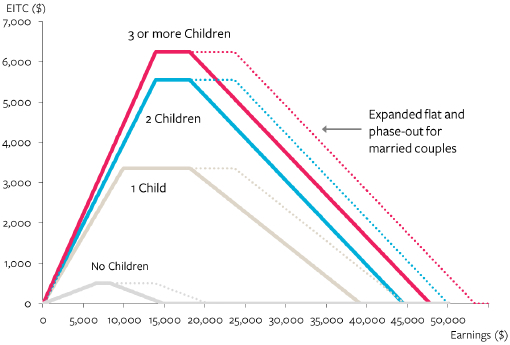

- The EITC reached 28.5 million tax filers in 2014. It supplements the income of a large share of U.S. families.10 This is both because the median household income is low ($56,516 in 2015), and because the eligibility of the EITC extends well into the income distribution. In 2015, single taxpayers receive the EITC with annual incomes up to $39,131 (with one child), $44,454 (with two children), or $47,747 (with three or more children) are eligible for the credit. Eligibility for married couples extends somewhat higher (see Figure 1).

- The EITC is also relatively generous. It can be as much as 45% of a family’s pre-tax income. The maximum credit in 2015 was $6,242 for families with three children, $5,548 for those with two children, $3,359 for those with one child, and $503 for those without children (see Figure 1).

FIGURE 1 EITC Schedule, by Family Type (2015 Tax Rules)

Source: Internal Revenue Service (2015).

Finally, the anti-poverty effects of the EITC, as measured by the Supplemental Poverty Measure, are significantly higher than official estimates.11 The Census measures estimate the direct effect of the EITC on families’ incomes (i.e. the tax benefit received on their income in a given year), but do not take into account the fact that families increase the amount they work, and therefore earn more, in response to the existence of the EITC, which rewards additional earnings.12 These earnings increases from increased employment (the indirect effects of the EITC) must be included when estimating the anti-poverty effects of the EITC. My study with Ankur J. Patel is the first one to be able to assess both the direct and indirect impact of the EITC on poverty. We show that the true anti-poverty effects of the EITC have been underestimated by up to 50 percent.

The EITC benefits maternal and children’s health

It is well known that higher family socio-economic status is associated with better health13 and better child cognitive development.14 However, it has been notoriously difficult to assess the precise causal impact of income on families’ well-being, and to disentangle the effect of income from other confounding factors (such as neighborhood or environment).

A number of studies have recently been able to overcome that difficulty by exploiting the 1993 reform of the credit – the EITC increased for those with any children as well as for those with two or more children relative to those with one child.15 They show in particular that:

- The 1993 expansion of the EITC lowered mother’s risk of cardiovascular disease, metabolic disorder and inflammations, and improved their mental health.16 The expansion also led to a reduction in smoking among single mothers with children.17 In work with Douglas Miller and David Simon, my co-authors and I show that this is also true among pregnant single mothers.18

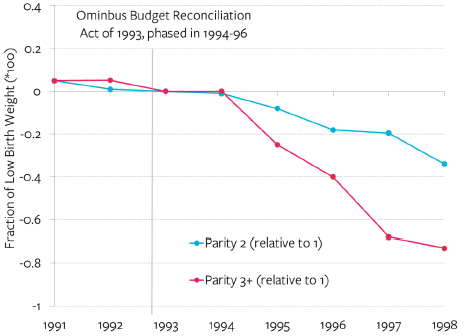

- My work with Miller and Simon also shows that the 1993 expansion of the EITC reduced the incidence of low birth weight (Figure 2) and increased mean birth weight.19 This improvement in birth outcomes is due to both more prenatal care and fewer negative maternal health behaviors (e.g. smoking).20

FIGURE 2 Effects of the EITC on Low Birth Weight

Source: Hoynes, Miller and Simon (2015), Figure 3

Lecture : For single women between the ages of 18-45 with a high school education or less, the propensity for second births (compared to 1st births) to be low birth weight declined by more than 0.2 percentage points in 1997 compared to 1993 (i.e. four years after the implementation of OBRA93). This is shown by the line “Parity 2 (relative to 1)”; the propensity for third births or greater (compared to 1st births) to be low birth weight declined by 0.7 percentage points in 1997 compared to 1993. This is shown by the line “Parity 3+ (relative to 1)”.

The EITC fosters children’s human capital and development

There is growing evidence that the EITC fosters children’s cognitive outcomes and educational achievement and attainment from elementary school to college:

- The EITC raises both math and reading test scores in elementary and secondary schooling.21 In particular, Dahl and Lochner find large positive effects of the EITC on math and reading test scores for children aged 8-14, with larger effects for younger children and boys.22 The EITC could also help to decrease aggression, as was found in the Canadian provinces which have benefits similar to the EITC.23

- The EITC is associated with higher rates of high school completion (or GED) and also higher college attendance rates.24 This in turn translates into better employment outcomes and higher earnings.25

Conclusion

The EITC is an effective tool to supplement the incomes of disadvantaged workers and to encourage work. It has become the cornerstone of U.S. anti-poverty policy and has transformed the experience of low-income families with children in the U.S. It has also dramatically increased employment among single women with children.

The benefits of the EITC extend well beyond an increase in cash flow for low-income families. It increases adult and children’s health, as well as children’s development.

Importantly, the benefits of EITC accrue not only to the recipients themselves, but also indirectly to taxpayers, through decreased health costs of those in poverty, and long-term increases in productivity and tax revenue generated by the higher education levels associated with EITC. This vital program continues to demonstrate significant benefits for our society, and ongoing research affirms the breadth of those benefits for the next generation.

Endnotes

- Autor, David. 2014. “Skills, Education, and the Rise of Earnings Inequality Among the ‘Other 99 percent’.” Science 23 May 2014, 344(6186): 843-851.

- Economic Report of the President. 2015. https://www.whitehouse.gov/sites/default/files/docs/cea_2015_erp_complete.pdf

- Eissa, Nada, and Jeffrey B. Liebman. 1996. “Labor Supply Response to the Earned Income Tax Credit.” Quarterly Journal of Economics, 11 (2): 605–37.

- Meyer, Bruce D. and Dan T. Rosenbaum. 2000. “Making Single Mothers Work: Recent Tax and Welfare Policy and its Effects,” National Tax Journal 53(4, part 2): 1027-1062; Meyer, Bruce D., and Dan T. Rosenbaum. 2001. Welfare, the Earned Income Tax Credit, and the Labor Supply of Single Mothers. Quarterly Journal of Economics 116 (3): 1063–114.; Eissa, Nada, and Hilary W. Hoynes. 2004. “Taxes and the Labor Market Participation of Married Couples: The Earned Income Tax Credit.” Journal of Public Economics 88 (9): 1931–58.

- The 1993 legislation increased the amounts of EITC for those with any children as well as for those with two or more children relative to those with one child. See Hoynes, Hilary and Ankur J. Patel. 2015. “Effective Policy for Reducing Poverty and Inequality? The Earned Income Tax Credit and the Distribution of Income”, NBER Working Paper 21340.

- Eissa, Nada, and Hilary W. Hoynes. 2004. op. cit.

- The next largest is SNAP, which removed 2.0 million children from poverty in 2015.

- Renwick, Trudi and Liana Fox. 2016. “The Supplemental Poverty Measure: 2015.” Current Population Reports P60-258. U.S. Census Bureau.

- See Hoynes, Hilary. 2016. “The Supplemental Nutrition Assistance Program: A Central Component of the Social Safety Net”, IRLE Policy Brief:

- http://irle.dream.press/the-supplemental-nutrition-assistance-program-a-central-component-of-the-social-safety-net/, Figure 1 “Persons lifted out of poverty by the biggest means-tested income support programs (millions 2014)”.

- Proctor, Bernadette, Jessica L. Semega and Melissa A. Kollar. 2016. “Income and Poverty in the United States: 2015,” Current Population Reports, p.60-256, U.S. Census Bureau, U.S. Government Printing Office, Washington, DC.

- The Supplemental Poverty measure extends the official poverty measure by taking into account many government programs aimed at assisting low-income families, such as tax payments and work expenses, in its family resource estimates. For more information: http://www.census.gov/hhes/povmeas/methodology/supplemental/overview.html.

- Hoynes, Hilary and Ankur J. Patel. 2015. op.cit.

- Case, Anne, Darren Lubotsky, and Christina Paxson. 2002. “Economic Status and Health in Childhood: The Origins of the Gradient.” American Economic Review 92(5): 1308–1334. Chetty, Raj et al “The Association Between Income and Life Expectancy in the United States, 2001-2014,” The Journal of the American Medical Association 315(16): 1750-1766, 2016.

- Reardon, Sean. 2011. “The Widening Academic Achievement Gap Between the Rich and the Poor: New Evidence and Possible Explanations.” In Richard Murnane & Greg Duncan (Eds.), Whither Opportunity? Rising Inequality and the Uncertain Life Chances of Low-Income Children. New York: Russell Sage Foundation; Rothstein, Jesse, and Nathan Wozny. 2013. “Permanent Income and the Black-White Test Score Gap.” Journal of Human Resources 48 (3): 509–44.

- As first presented in Eissa, Nada, and Jeffrey B. Liebman. 1996. op. cit.

- Evans, William N., and Craig L. Garthwaite. 2014. “Giving Mom a break: The impact of higher EITC payments on maternal health.” American Economic Journal: Economic Policy 6 (2): 258–90.

- Averett, Susan, and Yang Wang (2013). “The Effects of Earned Income Tax Credit Payment Expansion on Maternal Smoking.” Health Economics 22(11):1344-1359; Cowan, Benjamin, and Nathan Tefft. 2012. “Education, Maternal Smoking, and the Earned Income Tax Credit.” The B.E. Journal of Economic Analysis & Policy 12(1).

- Hoynes, Hilary W., Doug L. Miller, David Simon. 2015. “Income, the Earned Income Tax Credit and Infant Health,” American Economic Journal: Economic Policy, 7(1): 172–211.

- Hoynes Miller Simon. 2015. op. cit. Also see Baker, Kevin. 2008. “Do Cash Transfer Programs Improve Infant Health: Evidence from the 1993 Expansion of the Earned Income Tax Credit?” Unpublished working paper, University of Notre Dame; Strully, Kate W., David H. Rehkopf, and Ziming Xuan. 2010. “Aspects of Prenatal Poverty on Infant Health: State Earned Income Tax Credits and Birth Weight.” American Sociological Review 75 (4): 534–562.

- Hoynes Miller Simon. 2015. op. cit.

- Dahl, Gordon B. and Lance Lochner. 2012. “The Impact of Family Income on Child Achievement: Evidence from the Earned Income Tax Credit.” American Economic Review 102 (5):1927–1956. Chetty, Raj, John N. Friedman, and Jonah Rockoff. 2011. “New Evidence on the Long-Term Impacts of Tax Credits,” Statistics of Income Paper Series. Maxfield, Michelle. 2014. “The Effects of the Earned Income Tax Credit on Child Achievement and Long-Term Educational Attainment.” Working Paper.

- Dahl and Lochner, 2012, op. cit.

- Milligan, Kevin and Mark Stabile. 2011. “Do child tax benefits affect the well-being of children? Evidence from Canadian Child Benefit Expansions.” American Economic Journal: Economic Policy, 3(3), 175–205.

- Maxfield, Michelle. 2014. op. cit.; Manoli, Dayanand and Nicholas Turner. 2014.”Cash-on-hand and College Enrollment: Evidence from Population Tax Data and Policy Nonlinearities.” NBER Working Paper 19836.

- Bastian, Jacob and Katherine Michelmore. 2015. “The Intergenerational Impacts of the Earned Income Tax Credit on Education and Employment Outcomes,” Working Paper.