Overview

Policy-makers often aim to increase labor force participation by increasing the returns to work – either by cutting tax rates or reducing the rate at which benefits are phased out. A recent paper by Alexander Gelber, Damon Jones, and Daniel Sacks uses the Social Security Earnings Test to show that it takes significant time for people to adjust their work in response to changes in work incentives – typically two to three years. If the authors’ results on Social Security benefits are also true for other fiscal policies, this implies that such policy changes may do less in the short run to affect work, and that the full effects may materialize with a significant lag. This is relevant as policy-makers seek to project the effects of such policy changes on work over time.

Introduction

Several years after the official end of the Great Recession, the labor market has been slow to recover (Yagan (2016)1), and debates on the best policies to implement to help the economy fully recover are still vivid. Currently, policy-makers are considering a wide range of responses, including increases in government spending, tax cuts, and decreases in the rate at which government benefits are phased out. Many policy-makers argue for tax cuts, or decreases in benefit reduction rates, because they could help stimulate individuals to work more. Organizations like the Congressional Budget Office, in turn, project the effects of such policy changes on employment and other economic outcomes over time.

In a recent paper2, Alexander Gelber, Damon Jones, and Daniel Sacks study the labor supply response over time to a change in Social Security retirement benefits. Policy changes in Social Security retirement benefits since the 1990s provide a convenient “laboratory” for studying the effects of benefit reduction rates on people’s decisions about how much to work. Importantly, the authors develop credible evidence on the speed with which individuals respond to changes in work incentives.

The three authors find that the labor supply response to a change in Social Security retirement benefits materializes gradually over time. Until recently, the literature on the effects of tax policies on work decisions implicitly assumed that individuals immediately adjust their hours and earnings in response to fiscal policy. They did not take into account that a number of factors can prevent individuals from adjusting their earnings or their hours, because e.g. they might have a lack of knowledge of the tax regime and its changes, there are time and financial costs of job searches, etc. Casting new light on frictions in labor supply adjustments could help explain, for example, why only a slow rise in retirement at age 62 was observed subsequent to the introduction of the Social Security Early Retirement Age3.

The effects of fiscal policy on labor supply are slow to materialize: the example of Social Security benefits

To investigate the effects of tax policies on work over time, Alexander Gelber, Damon Jones, and Daniel Sacks focused on a Social Security retirement benefit (also known as the Social Security Old Age and Survivors Insurance (OASI)) and on a specific rule known as the Earnings Test (ET), which taxes retirement benefits according to a schedule that varies with the age of the claimant. Adults 62 and older receive the full amount of their Social Security retirement benefits if they claim OASI. However, if they continue to work and earn more than a certain level of earnings ($15,720 a year in 2016), their retirement benefits are reduced through the Earnings Test. In 2016, benefits are reduced by one dollar for every two dollars earned above $15,720 for claimants aged 62 to 65. The Annual Earnings Test creates a disincentive for earning more than $15,720 a year: for some individuals, it is worth it to earn up until the Exempt Amount, after which they effectively keep only half of their additional earnings, significantly reducing the incentive to earn above the threshold.4 This would presumably cause many affected individuals to cap their earnings at or near the Exempt Amount threshold. If this is true, one would expect to observe clustering around this amount when looking at earnings for this age group.

If individuals face no frictions in adjusting their earnings, then when they reach the age when the Earnings Test no longer applies to them, one should stop observing clustering in their earnings around the threshold. However, as noted above, individuals may face significant barriers to adjusting their earnings that could prevent immediate adjustment to policy changes and thus frustrate the fiscal policy goal of affecting short-run labor supply.

The Earnings Test is an appealing context for studying the speed of earnings adjustment for at least three reasons. First, whether individuals tend to cap their earnings around the Earnings Test threshold is easily visible on a graph, allowing credible documentation of behavioral responses. Second, the Earnings Test features very large benefit reduction rates (up to 50 percent), which is rarely observed elsewhere in the U.S. tax and transfer schedule. If we observe delayed adjustment even in response to such large changes in the amount of earnings people can keep, then we might conclude that the much smaller typical fiscal policy incentives would feature even more prolonged adjustment periods. Third, the Earnings Test is important to policy-makers in its own right, as it is a significant factor affecting the earnings of the elderly in the U.S.

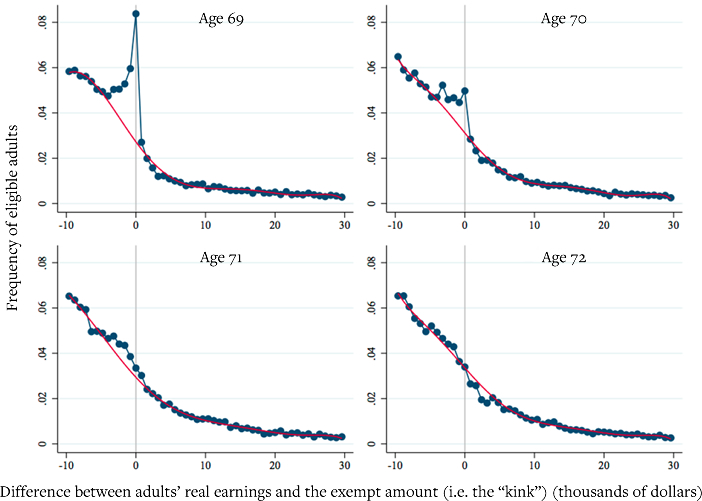

Figure 15 replicates Figure B.1 in Gelber, Damon and Sacks (2016). The three authors show that Social Security claimants continue to cluster around the earnings limit even after the Earnings Test no longer applies to them. Those aged 69 clearly cluster near the exempt amount, as expected. Crucially, many adults aged 70 and 71 behave as if the threshold still applied to them, and their earnings cluster around the threshold. The authors find similar patterns after a 1990 reform that reduced the benefit reduction rate for those aged 66 to 69 from 50 to 33 percent: earnings take around 2 years to adjust to this change. Thus, they conclude that across a number of contexts, it takes 2-3 years for workers to adjust their earnings in response to the incentives created by Social Security.

FIGURE 1 Frequency of workers earning less and above the exempted amount of the Annual Earnings Test, Ages 69 to 72 (1983 to 1999)

Source: Gelber et al. (2016) using a one percent random sample of all Social Security numbers.6

Note: The vertical axis measures the frequency of adults aged 69-72 for each level of earnings (bin width is $800). The vertical line at zero des the Earnings Test exempt amount.

Policy implications

Using the example of how people respond to changes in earnings limits for Social Security retirement benefits, Alexander Gelber, Damon Jones and Daniel Sacks show that people take time for their labor supply to adjust to new fiscal incentives. This delay is two to three years in the case of the Earnings Test. If the Social Security benefits example holds true for other fiscal policies, then we can conclude more generally that the short-run labor supply impacts of fiscal policies can be significantly attenuated, as labor supply responses adjust gradually. This suggests that using changes in incentives, like decreases in benefit reduction rates or tax cuts, to encourage people to work more may take longer to change behavior than was previously thought.

Endnotes

- Yagan, Danny. 2016. “Is the Great Recession Really Over? Longitudinal Evidence of Enduring Employment Impacts.” Working Paper: http://eml.berkeley.edu/~yagan/EnduringImpact.pdf.

- Gelber, Alexander M., Jones, Damon and Daniel W. Sacks. 2016. “Earnings Adjustment Frictions Evidence from the Social Security Earnings Test.” GSPP Working Paper: http://users.nber.org/~agelber/papers/adjustment081716.pdf.

- Gruber, Jonathan. 2013. Public Finance and Public Policy. New York: Worth Publishers.

- As noted in Gelber, Jones and Sacks (2016), when the Earnings Test reduces current Social Security benefits, future Social Security benefits may be increased through “benefit enhancement.” Even for those to whom benefit enhancement applies, the Earnings Test could also affect decisions for several reasons. The Earnings Test was roughly actuarially fair only beginning in the late 1990s. Furthermore, those whose expected life span is shorter than average should expect to collect OASI benefits for less long than average, implying that the Earnings Test is more financially punitive. Liquidity-constrained individuals or those who discount faster than average could also reduce work in response to the Annual Earnings Test. Finally, many individuals also may not understand the Annual Earnings Test benefit enhancement or other aspects of OASI (Liebman, Jeffrey B. and Erzo F.P. Luttmer. 2011. “Would People Behave Differently If They Better Understood Social Security? Evidence From a Field Experiment.” NBER Working Paper 17287; Brown, Jeffrey, Kapteyn, Arie, Mitchell, Olivia and Teryn Mattox. 2013. “Framing the Social Security Earnings Test”, Wharton Pension Research Council Working Paper 2013-06. Gelber, Jones and Sacks (2016) follow previous work and do not distinguish among these potential reasons for a response to the Annual Earnings Test in their main analysis.

- The authors made the same graph for the years 1990-1999 (see Figure 2: Histograms of earnings, 59-73-year-old Claiming OASI by Age 65), showing essentially the same results. In Figure 1 of this brief, the authors pool the years 1983-1999 to get extra statistical power.

- The sample is further limited to individuals who claim OASI benefits by age 65. It excludes person-years with self-employment income or with zero non self-employment earnings. The dots show the histograms using the raw data, and the polynomial curves show the estimated counterfactual densities estimated using data away from the kink.